Can’t-Miss Takeaways Of Tips About How To Apply For A Tax Rebate

If you meet the eligibility requirements listed, click.

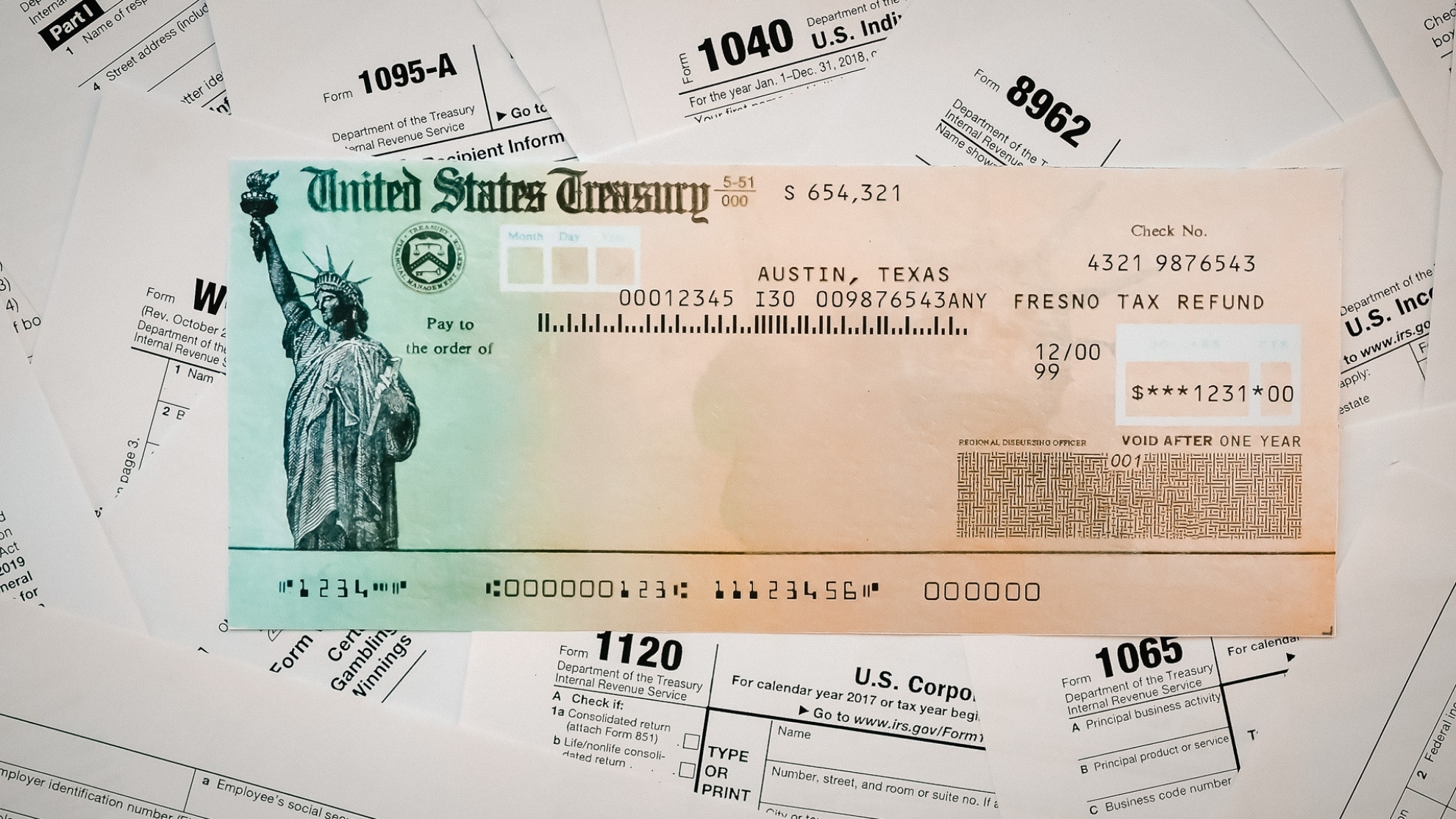

How to apply for a tax rebate. You must be a resident of connecticut; You can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount: To claim your rebate, use form gst189, general application for gst/hst rebate.

File your 2021 tax return electronically and the tax software will help you figure your 2021 recovery rebate. However, applications may be closed before may 31 if available funds run out. Click on file a ptc rebate application in the box labeled file a return or ptc form.

The property tax/rent rebate program is one of five programs. To be eligible for this rebate you must meet all of the following requirements: Use this service to see how to claim if you paid too much on:

To apply for a relief. Completing an application for refund or credit form. For homeowners, the savings increase from about $700 for.

The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. Instead, see how to claim the 2020 recovery rebate credit. The online portal to apply for the state’s newest property tax savings program is open.

If you are eligible to claim a rebate. It increases income eligibility for renters by $50,000, opening the program to an additional 300,000 renters. But up to $20,000 in federal student loans can.

![How To Get Tax Refund In Usa As Tourist For Shopping? [2022]](https://redbus2us.com/wp-content/uploads/2019/02/US-CBP-Tax-Refund-Clarification-US-Govt-does-not-refund-tax.png)

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)